We’ve invested in a new system to comply with HMRC’s MTD (Making Tax Digital) service – this means that information provided from the data input into our cloud system can be transferred electronically to your HMRC record.

To enable use of this service, you’ll need to ensure your MTD details are up to date.

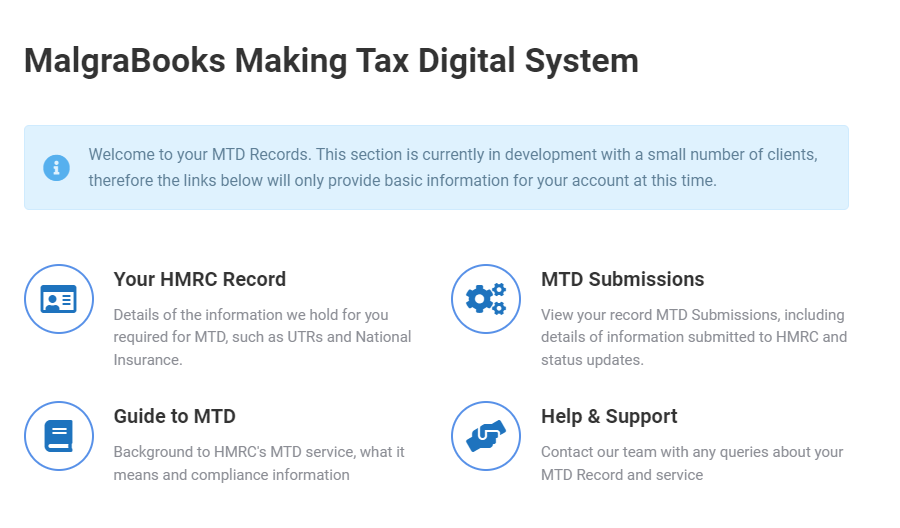

MTD Dashboard

To view your dashboard, select the relevant option from your menu – you’ll then be provided with a short summary of this section.

HMRC Record

You can view your record by selecting the relevant button above. This will then provide a summary of the information we currently hold for you, which is used for MTD submissions.

You can also update these details online through this section.

MTD Submissions

You can view past MTD submissions and the status of these by selecting the relevant button above. This will then provide a summary of data which has been sent to HMRC.