Sundry or Sundries are generally ‘miscellaneous’ values. They can be either a positive or negative (as mentioned in the sundries article here).

However when using the Malgra Spreadsheet, the system advises only to put expenses in the sundries box, and to take caution if the value is different to £1. This article explains why.

Background to the Sundries Function

Generally speaking, every consultant will have one key expense – the XPW Maintenance Weekly Fee. This is a nominal amount of £1, paid directly to Slimming World. It is designed to cover some costs towards the kit which is provided to you, and allow for any replacements / technical support etc.

This amount is an expense, and other expenses may also be added to this section. For example, previously CityGroup expenses (where you’d incurred charges using courier and SW paid these) would be created back to you.

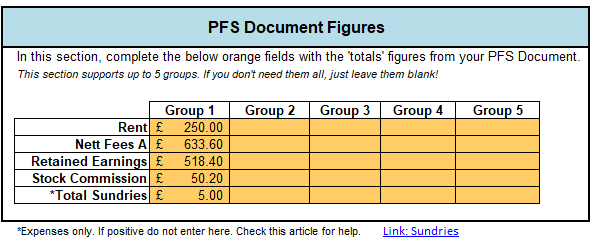

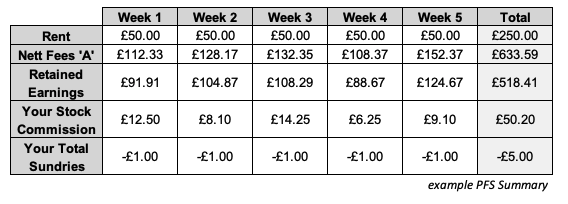

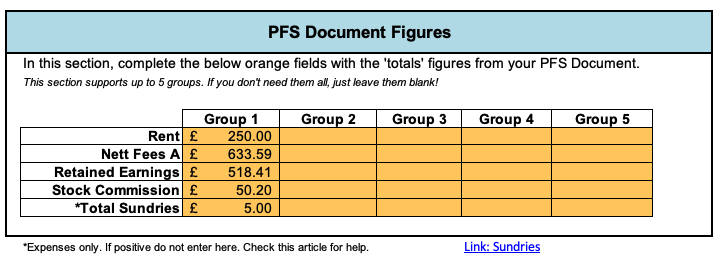

On the example PFS Document above, the sundries column is always £1, therefore this can be added to the spreadsheet as the final figure in the last column, £5, which is the calculation of 5 weeks on this example at £1 per week. Remember not to put it in as a negative number, just put in as ‘5’ – the spreadsheet will automatically work out the calculation for you.

However if it’s different to £1, it’s likely something has happened in the background. The below example takes you through this, and what to do.

Example Sundries Account

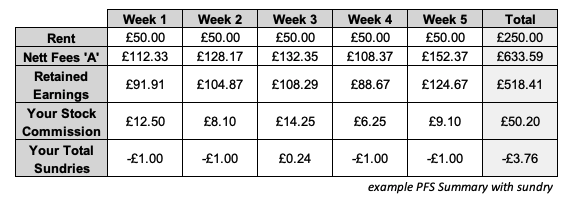

In this example, we would be completing our spreadsheet or Malgra Accounting document as usual. However when checking the monthly PFS, there is an unusual value within Week 3.

Although every week is showing £1 (and when we check the weekly summary, it’s the XPW Weekly Fee), in Week 3, there is a value of 24p which is being credited to the consultant. This has then meant the amount taken as an overall expense is £3.76, when we would have expected £5.00 (5 x £1 per week).

As such, we’ll need to check the weekly summary to see what has happened in the background.

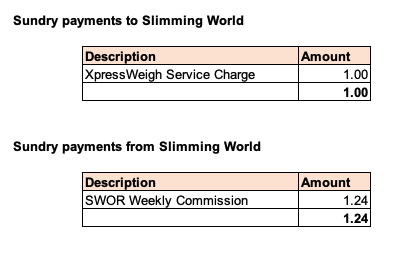

From the weekly PFS document, we can see there are two amounts which have been calculated in this transaction.

- An expense of £1.00

- An income of £1.24

The PFS Summary has then worked out the value, which in this case is a credit of 24p due when the expense (£1.00) has been deducted from the income (£1.24).

Adding the values to your Spreadsheet

On your spreadsheet, you would do the following transactions:

In the PFS section

Add the expense as £1 as usual for this week, so with our PFS example, that would be £5 in total

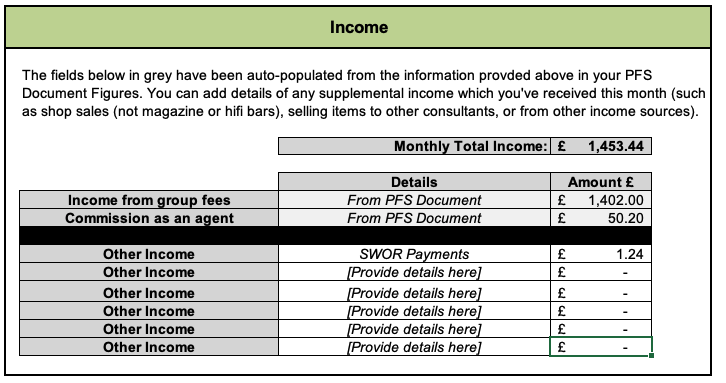

In the Income Section

Add the SWOR Payment in the ‘Other Income’ section to show the full amount credited.

The system will then make the correct calculations for your accounts.

What about when it’s an expense?

If the sundries amount is a larger value which is shown as an expense to Slimming World, you would follow the process above for the standard XPW values – and then add the additional expenses to the expenses section of your document!

Summary

Although in this example, it doesn’t appear a large amount, any transaction must be added to your business accounts to show a true reflection. If you have a lot of credited sundries, such as SWOR or Gift Voucher income, this can add up.