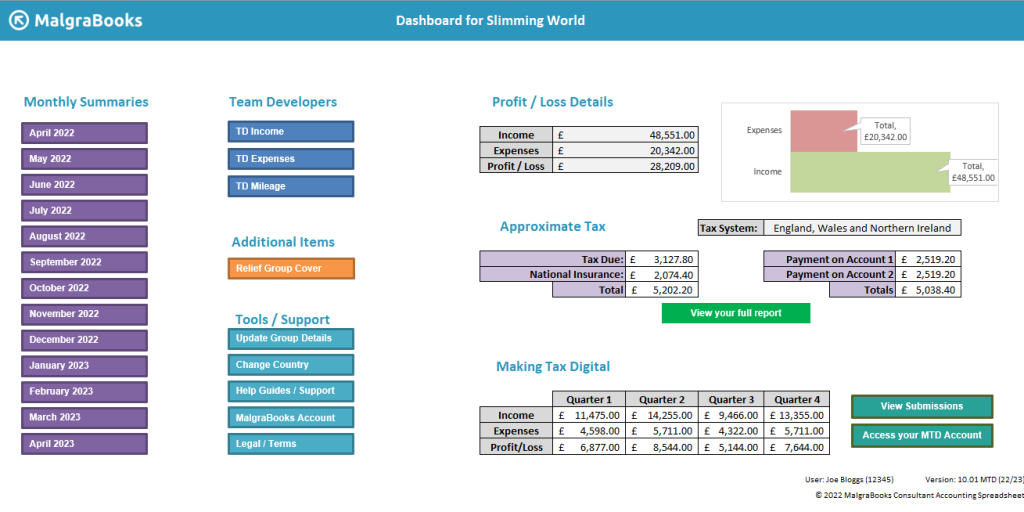

Your main dashboard provides an overview of the key areas of the software, as well as details of indicative tax, national insurance and Making Tax Digital information.

Tip: You can quickly get to your dashboard by pressing the purple ‘Menu’ button at the top of any screen.

Monthly Summaries

These purple buttons will take you through to your monthly summary pages where you can view and enter information for your spreadsheet. The system will automatically take you to the relevant section depending on the month chosen.

Team Developers

If you’re a Team Developer, you’ll find three blue buttons which take you to separate sections of the document for your TD activity. These allow the input of your TD income, any expenses you’ve incurred as a TD and also any mileage.

These are kept separate to allow for reporting of your TD activity away from your consultant activity – however are merged to create the totals for your business accounts.

Additional Items

The orange button will take you to your Relief Group cover table

Tools / Support

You can access some administrative options through the teal coloured buttons, such as changing your Group Details or Country. There’s also links to relevant articles and support options

Profit/Loss Details

This section provides the three key numbers needed for your tax return, created from the information which has been entered into the spreadsheet. A small chart also demonstrates the overall position of your self employed business.

Approximate Tax

This section shows the amount which is likely to be due, along with any National Insurance or Payments on Account

Making Tax Digital

You can view a summary of your account here – and have options to access your dashboard or view submissions through the MalgraBooks website.