Following last-minute changes to the National Insurance allowances, we’re building new reporting tools online to view your data in further detail.

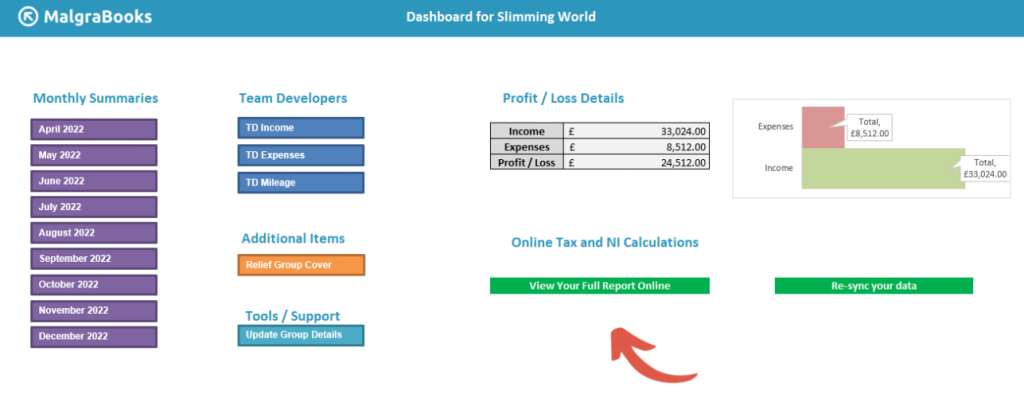

To access the new reports, click the ‘View your report online’ button on the dashboard.

The system will then load your MalgraBooks Client dashboard. If required, login to your account.

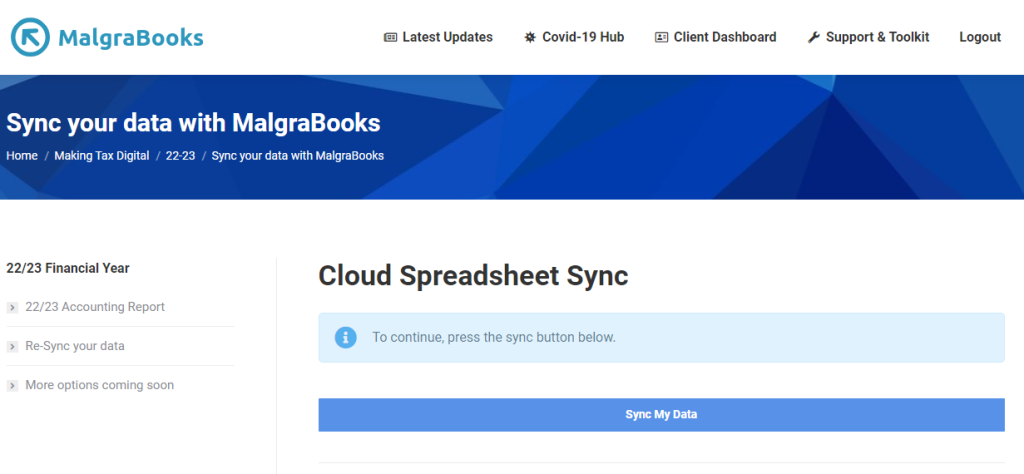

Once ready, you’ll be provided with the Cloud Spreadsheet Sync page – simply click the ‘Sync Data’ button to continue.

The system will then sync data from your cloud spreadsheet.

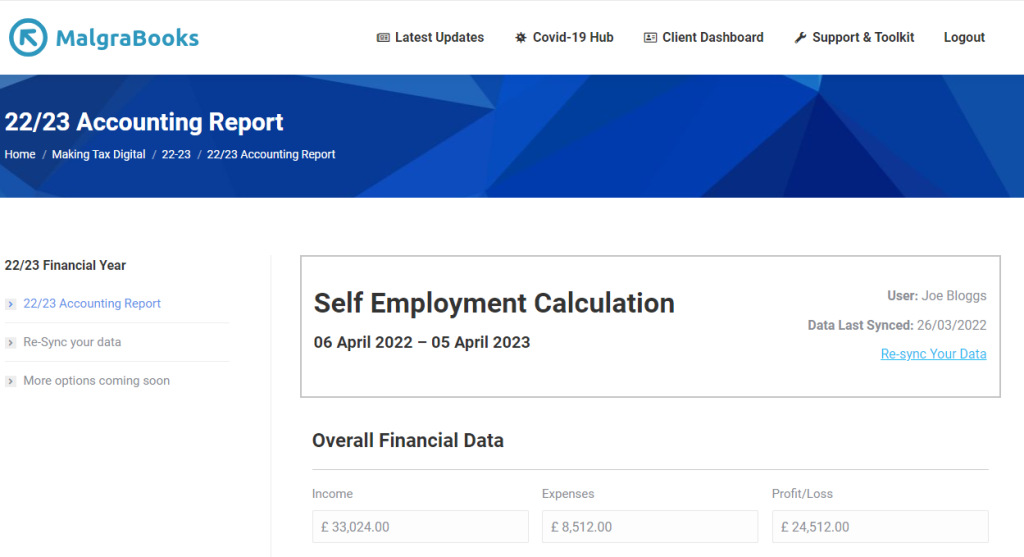

Once synced, you’ll then be provided with your Self Employment Calculation

Overall Financial Data

The first section of this page provides details of who is logged in, and the date when the data was last synced. You can re-sync the data using the button provided.

The overall three figures needed for your tax return are shown – your income, expenses and profit/loss for the financial year.

There are then further calculations provided below.

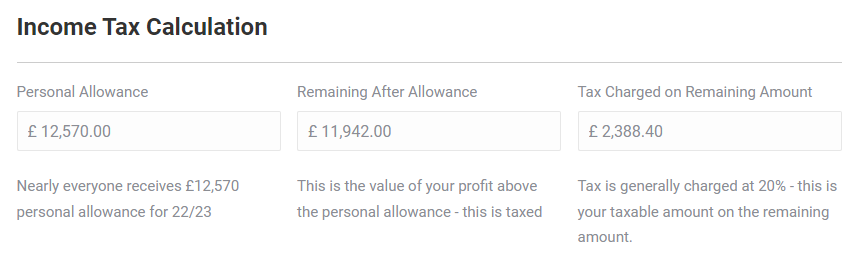

Income Tax Calculation

In the example above, you can see that the overall profit/loss was £24,512 – this figure has then been used for calculations

The Income Tax Calculation removes the Personal Allowance (£12,570) from the profit of £24,512 – leaving £11,942 which is used for Tax and National Insurance

The box on the right then shows the approximate tax amount at 20% which would be charged on this remaining balance.

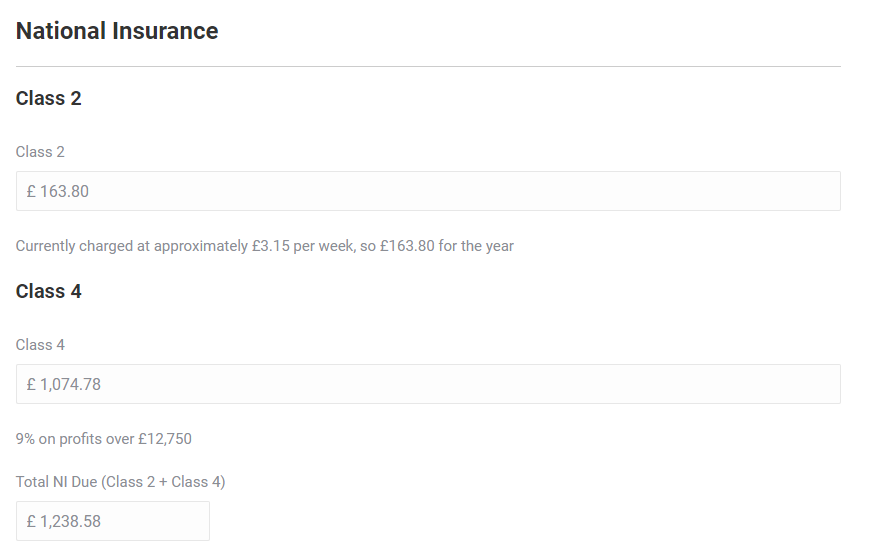

National Insurance

The next section shows NI Calculations on the profit amount

Class 2 and Class 4 have been charged as the profit was above the personal allowance for 22/23. If you have not met the threshold, this section may not appear.

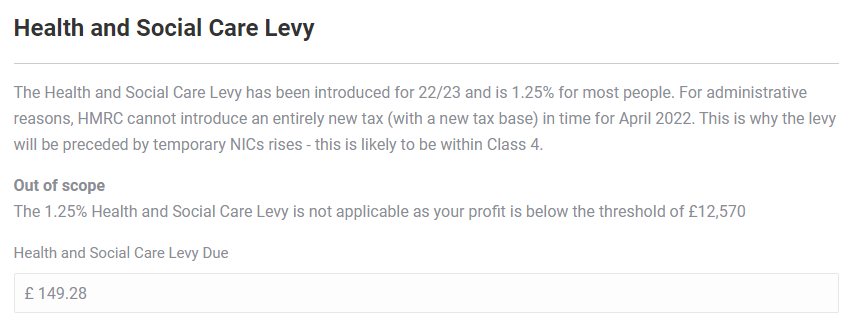

Health and Social Care Levy

Introduced for the 22/23 Tax Year, this is a 1.25% levy charged for most people where the earnings are above the personal allowance.

In this example, 1.25% has been shown against the profit of £11,942.

If you have not met the threshold, this section may not appear.

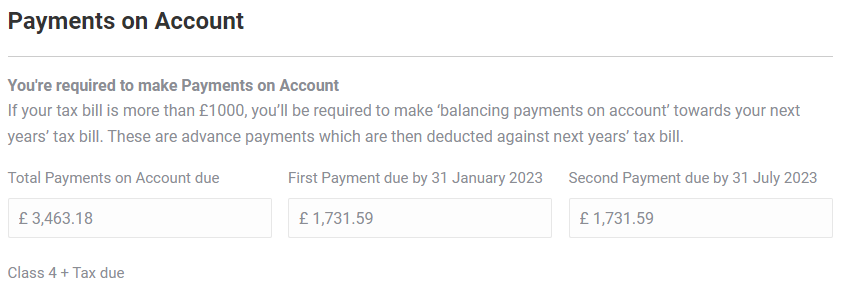

Payments on Account

Where Payments on Account will be due, this is shown below. The calculation is based on Tax and NI Class 4 which is due, and the different payments are shown in the fields above.

Note: Due to rounding, this could be 1-2p out. If you have not met the threshold, this section may not appear.

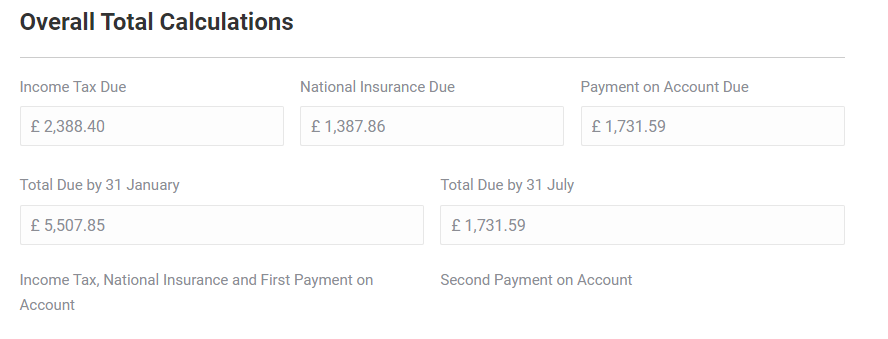

Overall Tax Calculations

At the bottom, you’ll find an overall calculation

This section pulls together all of the options above – from Income Tax, National Insurance and Payment on Account.